Gift Aid is 25 today and has generated over £60 billion

The tax relief Gift Aid was introduced 25 years ago today and since then has helped generate more than £60 billion for good causes according to research by Charities Aid Foundation. This makes it “the world’s greatest charitable tax relief”, according to the charity.

The scheme was introduced on 1 October 1990 by the then Chancellor of the Exchequer Sir John Major. Today he said:

“I am delighted that – over the past 25 years – the scheme has encouraged more people to give, thus helping those in our society who have the least, to gain the most”.

The £60+ billion total includes more than £12.3 billion in tax relief. CAF says this is “the equivalent of 120 Red Nose Days or 368 Children in Need Appeals”.

According to CAF, this year alone charities will claim an estimated £1.2 billion in tax relief through the scheme, representing around 6% of the voluntary income received by the sector.

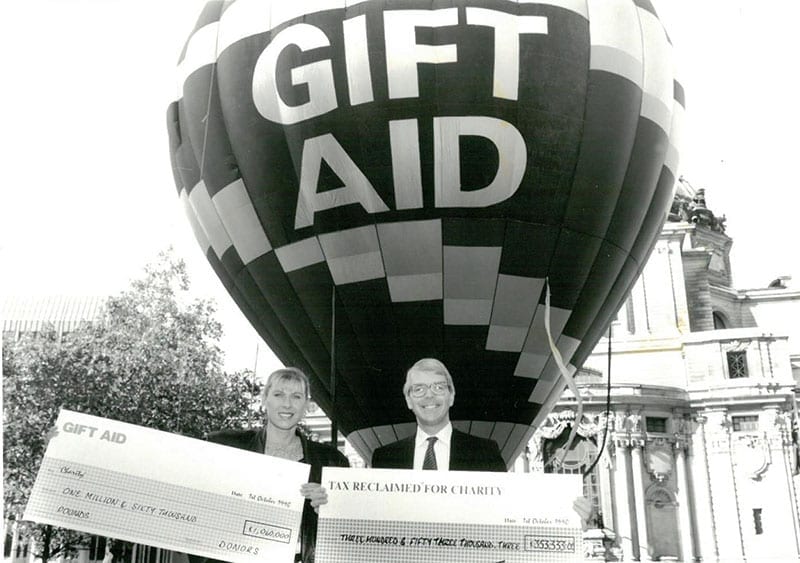

John Major MP and swimmer Sharron Davies launch Gift Aid in London’s Parliament Square in a hot air balloon.

Sir John explained why he introduced Gift Aid and why it still matters. He said:

Advertisement

“We live in a world that is richer than at any time in history, and yet, amidst that wealth, are many people who have fallen behind and who are in desperate need.

“Governments, however wealthy, cannot meet the scale of need that exists. That is why philanthropy and charity are so important. Charity is one of the highest of all human emotions, and Britain is one of the most charitable nations in the world.

“As Chancellor of the Exchequer I felt it was only right that the act of giving was maximised by introducing the Gift Aid scheme, which is now worth over one billion pounds to charities. I am delighted that – over the past 25 years – the scheme has encouraged more people to give, thus helping those in our society who have the least, to gain the most.”

CAF was instrumental in the implementation of the scheme and has been involved in its development over the last 25 years. It campaigned to replace the rigid system of covenants, which required the donor to enter into a legally binding contract to make regular donations to a charity.

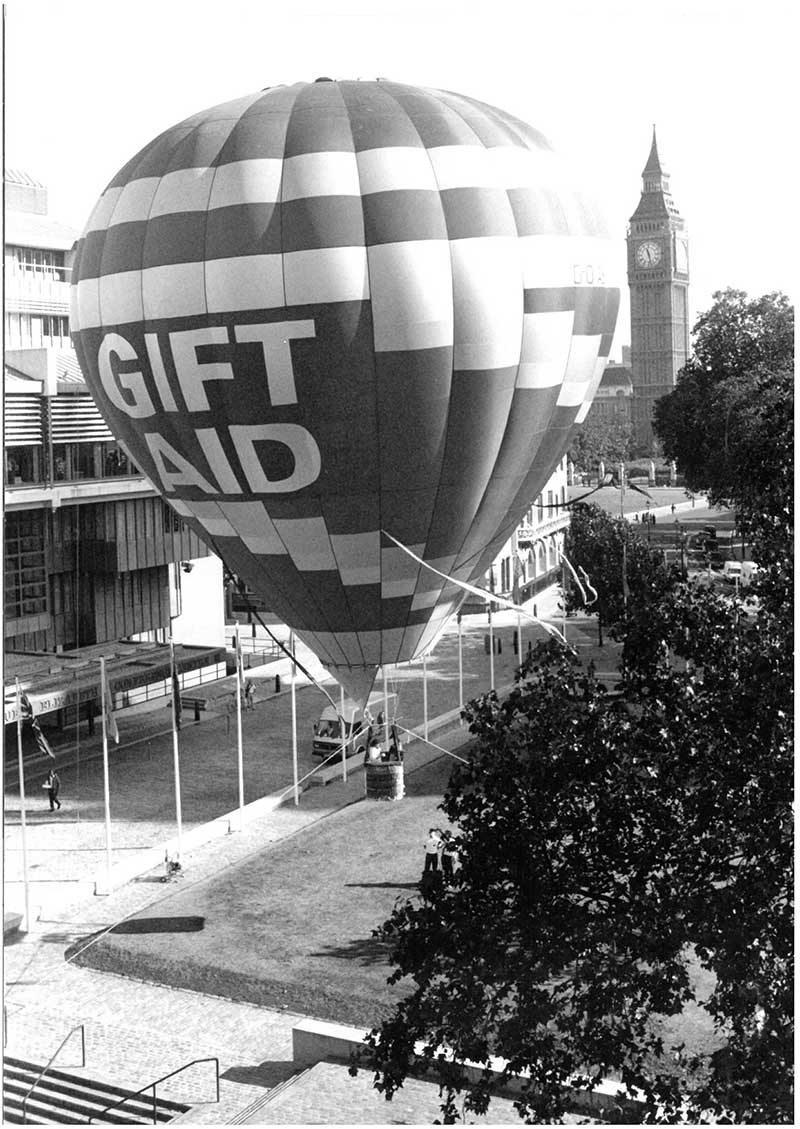

John Major and Sharron Davies as Gift Aid lifts off on 1 October 1990

A hot air balloon launches Gift Aid on 1 October 1990

Gift Aid expanded in 2000

Gift Aid originally applied only to larger donations, but this was removed in 2000 when the Chancellor Gordon Brown scrapped the lower limit. Tax relief could then be applied to any cash gift providing the donor had paid the equivalent in tax, meaning many millions more donations qualified.

Since then, the overall growth rate for Gift Aid receipts has been 14% per year, hitting £1 billion for the first time in the year 2011-2012.

John Low, Chief Executive of Charities Aid Foundation, said:

“Gift Aid is one of the best things government has done for charities. What better motivation to give than the knowledge that for every pound you donate an extra 25p will be given to the causes you care about.

“Since the lower rate on a donation valid for Gift Aid was removed, the scheme is truly inclusive and proved to be a success with governments of all complexions.

“Britain is one of the world’s most generous countries and it is fitting that we have the world’s greatest charitable tax relief. Our mission now is to encourage even more people to use Gift Aid so charities can reclaim their tax on donations.”

Is it the world’s greatest charitable tax relief?

Charities Aid Foundation claims that Gift Aid compares favourably to tax relief on charitable donations in other countries, where tax incentives are often capped. For example, in the USA tax relief on donations can only be claimed on a maximum of 50% of what the donor earned that year.

The promise of more tax-effective giving from Gift Aid at its launch

Gift Aid – “the world’s greatest charitable tax relief”, says CAF, 25 years on

[message_box title=”How Gift Aid works” color=”blue”]

Any donor giving cash to charity can enhance their donation by signing a Gift Aid declaration. The charity can then reclaim the basic rate tax the donor has already paid on that donation. A £1 donation will therefore be worth £1.25 to the charity, but only if a declaration is signed.

[/message_box]