Figures to the end of March show legacy income rose 15% in a year

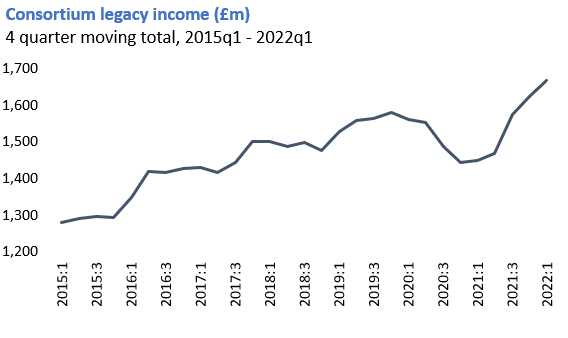

New data from Legacy Foresight’s Legacy Monitor benchmarking programme shows that legacy income for its charities saw an annual increase of 15% in the 12 months preceding the end of March 2022, reaching £1.67 billion.

The increase follows a drop in 2021, also noted in Smee & Ford’s figures, caused largely by continued delays in probate administration and the effects of the pandemic.

The 82 UK charities in the benchmarking programme account for approximately 50% of the UK legacy market.

Advertisement

The Legacy Monitor also shows that the number of bequests received reached a peak over the first three months of 2022, with an 18% increase on the previous quarter.

The charities surveyed experienced a 6% rise in the average value of residual gifts, which Legacy Foresight says was likely supported by rising house prices. Latest ONS data suggests that UK house prices were 11% higher in February 2022, compared to 12 months before.

However, Legacy Foresight warns that the deepening cost-of-living crisis in the UK poses a notable risk to legacy income over the medium-term. Rising interest rates could have a significant impact on property prices in 2023 and 2024, resulting in a knock-on effect on residual bequest values.

Jon Franklin, Economist at Legacy Foresight, said:

“Following a turbulent three years, legacy income has made a strong recovery to fall back in line with its long-term trends. However, whilst the number of bequests to charities is currently high, it still remains lower than we might have expected given the large numbers of deaths seen during the pandemic.

“Prospects for legacy income continues to look positive for the next 12 months. Although, with interest rates on the rise, there is some concern over the impact to property prices and whether the cost-of-living crisis will have an effect on the legacy market.”