Low take up of tax relief on donations means charities could be missing out on millions

Charities could be missing out on over £940 million a year through donors failing to claim tax relief on the money they give, research from Handelsbanken Wealth & Asset Management suggests.

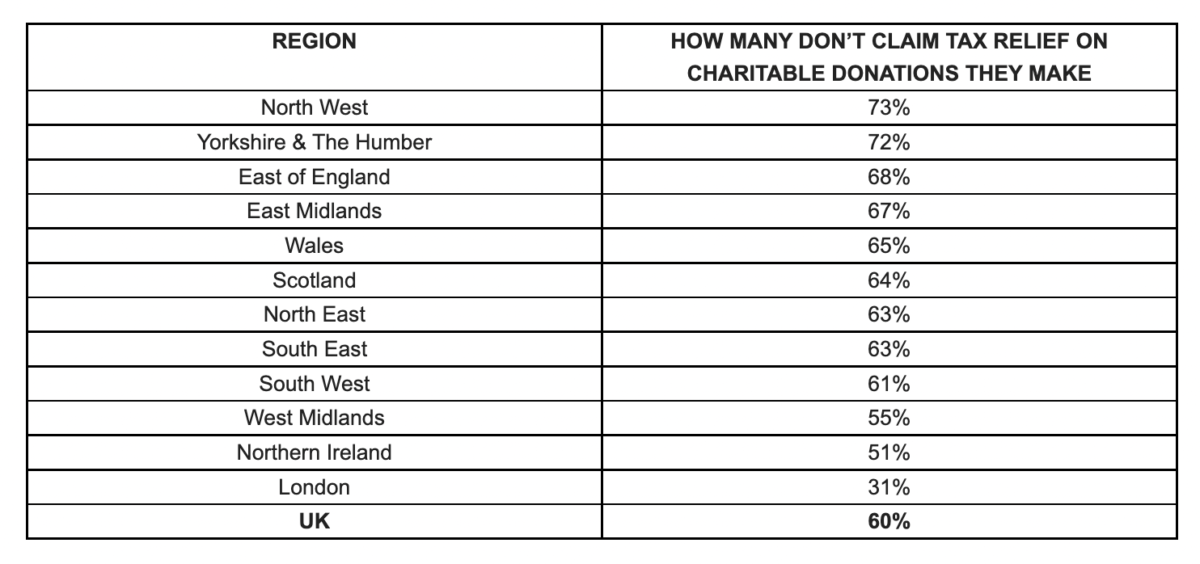

The nationwide study of just over 2,000 people found 60% of charity supporters are not claiming tax relief on donations distinct from money given directly through their salary. Based on ONS UK population estimates, it estimates these donations to be worth around £4.7 billion, which with 20% tax relief would yield more than £940 million for charities.

Handelsbanken Wealth Management & Asset Management’s research highlights that only 59% of adults are aware they can claim personal tax relief on any charitable donations they make.

Advertisement

Its study shows 22% are definitely planning on leaving money to good causes in their will, with an average donation of more than £2,200 planned, which, it says, could add up to £26.5 billion.

Across the country, the study shows, more than two out of three adults (68%) say they donate to charities every year – the equivalent of around 35.9 million people. The average given is £499, equating to a total of £17.9 billion donated every year overall. Young people (18-34) donate more than twice the average at £1,056 while older people (55+) donate a quarter of that at £250. Londoners donate an average of £1,546 per year – more than three times the UK average.

But Handelsbanken Wealth Management & Asset Management’s research suggests that knowledge of tax rules on donations to charity could also be better, with less than one in five for example aware that someone leaving 10% of their estate to charity would see the Inheritance Tax on the value of estates above the IHT threshold reduced from 40% to 36%.

Mark Collins, Head of Tax at Handelsbanken Wealth Management & Asset Management said:

“In common with many other sectors, charities have suffered during the pandemic, with fundraising badly affected and the Charity Commission estimating 60% of organisations have seen incomes suffer.

“Charity donors will want to see the organisations they support receiving the full benefit of donations, which should include claiming the tax relief whether it is through Gift Aid, or consulting a financial planner.

“Wealth advisers can guide people through how to maximise their donations, so they are effective for charities and their own IHT planning. Giving as much as 10% of your estate to charity can reduce IHT rates from 40% to 36% which would be very much welcomed by charities and potentially better reflect people’s wishes.”

Regionally, 73% of people in the North West and 72% in Yorkshire & The Humber are not claiming tax relief on donation. Londoners are the best at claiming tax relief, although 31% are still not doing so.