Finance worries keeping social entrepreneurs & charity leaders awake at night

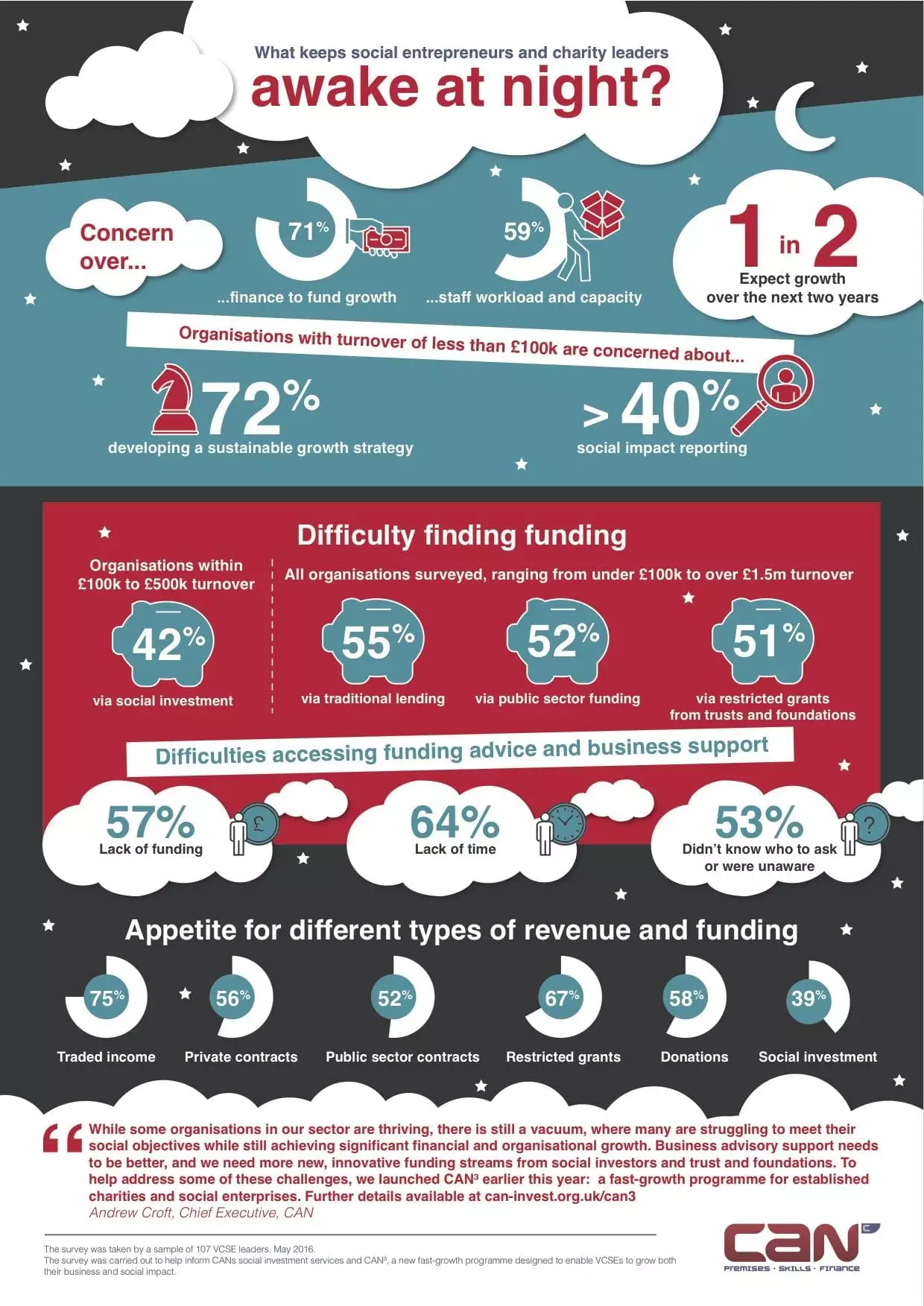

The majority of social venture leaders can’t sleep at night due to concerns surrounding access to finance, a snapshot survey from social enterprise network CAN has revealed.

According to the survey, 71% face sleepless nights because they are concerned or extremely concerned about access to finance to fund both cash flow and growth. Organisations are also struggling to balance organisational growth with day-to-day cash flow and staff resource, the results show, with 59% expressing concern for staff workload and capacity.

In addition:

- Of organisations with turnover of less than £100k, 72% were concerned or extremely concerned about developing a sustainable growth strategy, while more than 40% expressed specific concern over social impact reporting.

- 42% of organisations within the £100-£500k turnover bracket said they found it difficult or impossible to access social investment, while 55% of all organisations surveyed said they had the same difficulty accessing traditional lending.

- 52% of all organisations surveyed, ranging in turnover from under £100k to over £1.5m, said that they find it difficult or impossible to access public sector funding, and 51% said the same of restricted grants from trusts and foundations.

Respondents put difficulties accessing funding advice and business support primarily down to lack of funding (57%) and lack of time (64%), while 53% said they didn’t know who to ask, or were unaware of what support and finance is available.

However, despite the difficulty many respondents reported with generating income, the survey also identified an appetite for different types of revenue and finance from VCSEs:

Traded income 75%

Private contracts 56%

Public sector contracts 52%

Restricted grants 67%

Donations 58%

Social investment 39%

The survey was carried out to identify common barriers to growth for VCSEs, which in turn will better inform how CAN should shape its social investment services to the sector. It also informs CAN³: a fast-growth programme designed to enable VCSEs to grow both their businesses and social impact.

Andrew Croft, chief executive of CAN, said:

“It’s not surprising to see the lack of support in terms of finance and business strategy expressed by the social sector. While some organisations in our sector are thriving, there is still a vacuum, where many are struggling to meet their social objectives while still achieving significant financial and organisational growth. Business advisory support needs to be better, and we need more new, innovative funding streams from social investors and trust and foundations. We hope that CAN³ will help address some of these challenges.”

Advertisement