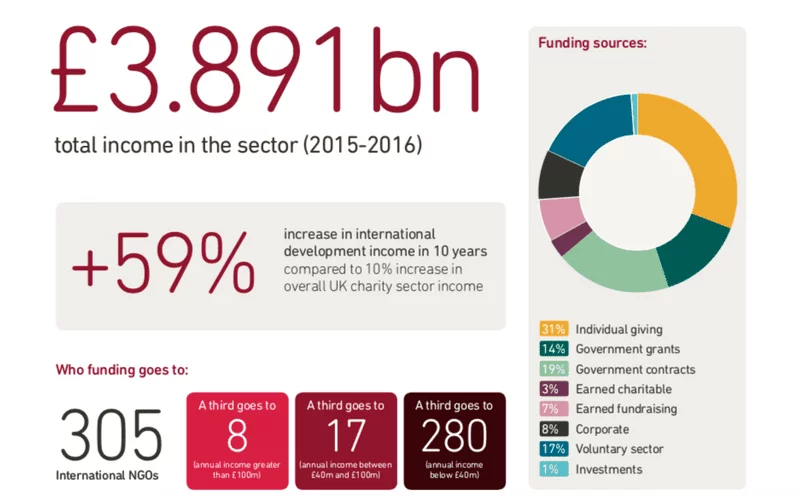

Development sector income up 59% in a decade, Bond reports

Overall income to the development and humanitarian sector grew by 59% between 2006 and 2016, a survey of Bond members has shown, although most funding growth occurred in bigger organisations.

The report found that overall income for 305 of Bond members stood at £3.8bn as of April 2016, compared to the wider UK domestic charity sector, which grew by 10% over the same period.

Individual giving was the largest income stream to the humanitarian and development sector, accounting for 31%. This was followed by government contracts (19%), government grants (14%) and voluntary sector (17%), which includes trusts and foundations.

Government income – grants and contracts – are amongst the strongest growing areas of income, representing 33% of total funding, which according to the report is almost exactly the same level at which the government funds the UK domestic charity sector (32%).

According to Bond, which is a UK network of over 400 NGOs, funding to international development organisations now represents a twelfth of charity sector funding in the UK, with social services the largest (£10.6bn), followed by culture and recreation (£5.8bn) and health (£5.4bn).

However, the report also shows that the majority of growth in terms of funding occurred within organisations earning over £20m. A third of income went to the eight largest organisations, which each have annual income greater than £100m, another third went to 17 INGOs with income between £40m and £100m, while the remaining third went to 280 organisations with annual income below £40m.

The report reveals some differences however, with individual giving and voluntary sector income strong for organisations with income below £500k. Earned fundraising from selling donated goods or events tickets to individuals has shown strong recent growth with organisations of income between £500,000 and £2m, while earned charitable income from services such as consultancy and rent appears to have grown noticeably in the £2m to £5m group.

In a survey last year, 55% of Bond members identified diversifying income and becoming financially sustainable as their biggest long-term challenge.

Murtaza Jessa, haysmacintyre chartered accountants and tax advisers, Head of Charities said:

“The overall picture of INGO funding over the last ten years appears at first sight to be very positive. However, it is clear that there are winners and losers and there is some striking polarisation, with the larger organisations attracting the lion’s share of government funds, individual giving and voluntary sector income. This report is a useful reference for INGOs to plan funding strategies and think afresh about funding. It is also a valuable tool to help organisations consider their mission and the sustainability of their underlying business models. The lessons for organisations are clear: they must remain nimble and not take any funding for granted.”

Advertisement