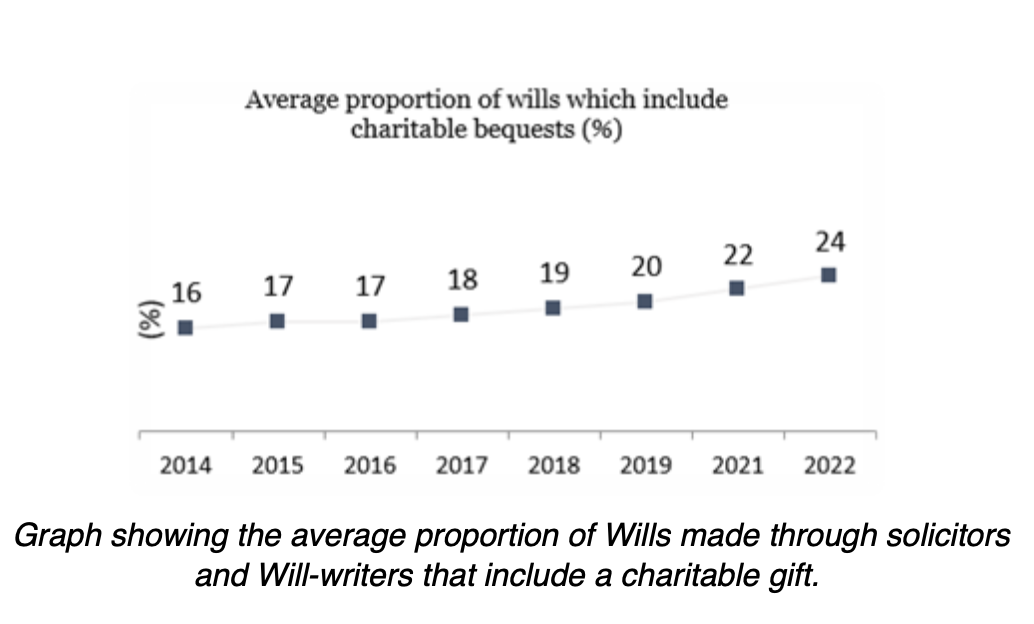

1 in 4 Wills written by solicitors & professional Will-writers now include a charitable gift

Almost a quarter (24%) of Wills handled by UK legal advisers now include a donation to charity; up from 16% in 2014, according to a study commissioned by Remember A Charity.

The study, based on the views of 230 solicitors, professional Will-writers and IFAs across the UK, found also that solicitors and professional Will-writers are playing an increasingly important role here, with almost three-quarters (73%) always or sometimes raising the option of leaving charitable bequests in Wills to their clients.

The release of the 2022 Savanta Will-writing tracking study, commissioned by Remember A Charity, follows yesterday’s new figures from Legacy Foresight, which show that gifts in Wills raised £3.85 billion for good causes in 2022, making them the largest single source of voluntary income for charities in the UK.

Advertisement

Remember A Charity’s commissioned study found that over a third (36%) of all solicitors and Will-writers say they always raise the option of a charitable legacy with relevant clients, while less than one in 10 (9%) say they never do so. Of those who don’t always raise the issue, more than a quarter (26%) say the most prominent reason is because they do not want to influence their client’s decision.

Lucinda Frostick, Director at Remember A Charity, commented:

“When it comes to growing legacy giving, engagement and support from across the Will-writing community is crucial. This benchmarking study charts a continual rise in the proportion of Wills made through solicitors and Will-writers that include a charitable gift and that’s so important for charities that rely on legacy income. These donations may not arrive for some years yet, but they will fund vital services and charities’ core costs for generations to follow.”

When asked about the most common barriers to legacy giving for clients, solicitors and Will-writers said they believed the most common reasons were that they want to leave their full estate to their family (83%), that they have difficulty choosing which charity/charities to support (38%) or that it may cause/lead to dispute (38%).

Three-quarters of the firms in the survey (77%) have acted or assisted in the administration of estates that include a legacy to charity. Over half (56%) of those said they found charities easy to deal with. 13% indicated said they didn’t find charities easy to work, with the top cited reason (22%) being that they communicate too often.