12 fundraising research developments and tools for July 2015

Here is our round-up of fundraising research, case studies and tools that we can across this month. Some are new, while others have been around for a while but deserve another airing.

1. The Science of Philanthropy

Chuck Longfield, Chief Scientist at Blackbaud, presents on the science of philanthropy.

[Video from Blackbaud at www.youtube.com/watch?v=aEgf68zLrZg is no longer public]

Advertisement

He looks at one week of fundraising appeals that he has received. He muses on whether, in a direct mail appeal, to mention a donor’s last donation amount and add ‘other’ or to add 50% and 100% increments after it, to stimulate a bigger gift. Or indeed, to circle one of the prompted levels of giving to make it stand out. Or perhaps it is better to prompt with unusual, non-rounded numbers on the assumption that donors will likely round-up.

Don’t expect an answer, but he does go on to explain his interest in the science of philanthropy, from the early days of researching PBS stations’ fundraising approaches.

He reveals that there are 500 professors around the world who conduct fundraising or philanthropy research.

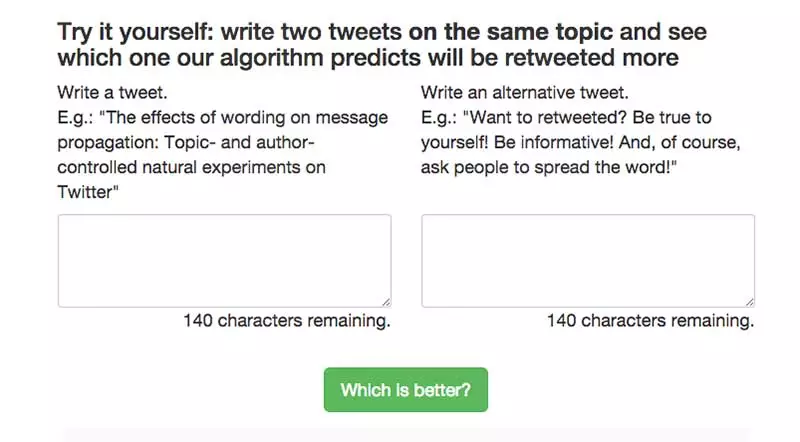

2. Want to be retweeted more?

The Retweeted More tool will predict which version of two similar tweets will get retweeted more. “The main idea is to automatically learn what wording works better by examining a large number of pairs of tweets posted by the same author containing the same url”.

The tool lets you test two similar tweets for free. The algorithm that underpins it was developed in research published as The effect of wording on message propagation: Topic- and author-controlled natural experiments on Twitter by Chenhao Tan, Lillian Lee, and Bo Pang in Proceedings of the 52nd Annual Meeting of the Association for Computational Linguistics (ACL’2014).

3. In Scotland, women are more likely to donate to and support charities

A YouGov Scottish Omnibus survey on attitudes to charity reports that women are more likely than men to donate to a charity.

• Ad hoc donations (over the phone, in a collecting box, online etc) is the most popular way to donate to charity among Scottish adults: 55% of men and 59% of women said they had contributed in this way during the last 12 months.

- 30% of women said they donated to charity on a regular basis via direct debit, compared to 24% of men.

- 56% of women say they have bought goods from a charity in the past year, compared to 35% of men.

- 24% of women had taken part in a fundraising event, such as a fun run or bake sale, in the past year; 17% of men said they had done so.

Other findings included:

- women are more likely to sponsor someone who is fundraising (53% women v 45% men)

- more women than men have signed a petition or written to a politician about a particular campaign (23% women v 20% men)

- TV advertising has the greatest impact upon adults in Scotland: 49% said this was the type of advertising that resonated best with them, compared to 7% for newspaper and magazine adverts, 5% for online advertising, and 4% for radio advertising.

Karen Barzanji, Head of YouGov Scottish Omnibus said:

“It is clear that there is an opportunity for not-for-profits in Scotland, if they can appeal to men’s charitable nature through their advertising methods. If they were to be successful in receiving donations with the same frequency as we see from women, it could make a huge difference to the scope and effectiveness of the organisation.”

The YouGov Scottish Omnibus is the only regular Scottish Omnibus and interviews a nationally representative sample of Scottish adults (aged 18+) twice weekly. This specialist omnibus is the perfect way to get a snapshot of what the Scottish general public think, in 48 hours.

You can download the survey results from the YouGov Scottish Omnibus.

4. Oxford Centre for the Study of Philanthropy opens

The Oxford Centre for the Study of Philanthropy (OCSP) has opened with a seminar on the history of philanthropy led by Somerville College historian, Dr Frank Prochaska.

The OCSP, run by Charles Keidan, “aims to be a leading academic research centre, bringing together scholars, policymakers and practitioners to advance our understanding of the practice and theory of philanthropy”.

It is an independent charitable entity with trustees and an advisory board, affiliated with and based at Green Templeton College at the University of Oxford.

Its research will focus on three areas:

- the philanthropy phenomenon (eg. new forms of philanthropy, major philanthropic areas today, eras of philanthropy)

- policy questions about philanthropy (eg. the influence of tax regimes on philanthropy, the relationship between philanthropy and justice, accountability, impact measurement)

- the practice of philanthropy (inter-generational philanthropy, donor-recipient relationships, decision-making, cross-cultural considerations in philanthropy).

Its inaugural seminar series will run in Oxford and London. You can download its brochure in PDF.

5. What do people share online?

In a round-up of its own Social Media Examiner reports that:

- in 2014 US consumers doubled the volume of what they shared on mobile devices

- Facebook is still the most popular social channel for sharing content, accounting for 10 times the volume of items shared compared to its closest competitor Pinterest.

- Consumers share ‘list’ and ‘why?’ articles the most

6. Peer pressure can drive up donations on online giving sites

Research led by Professor Sarah Smith at Bristol University has found that large gifts on an online giving site can influence the amount that others then give. Her team analysed 300,000 donations to the online giving pages of runners using JustGiving and Virgin Money Giving.

She found that for every additional £10 above the average that was donated, subsequent amounts donated increased by £2.50. Unfortunately the inverse effect applies for donations that are less than the average amount: they result in a reduction in the amounts given.

The message for fundraisers is that donors, where they can see who has given and how much, will judge how much they will give based on what others have given, not on the charitable need or reputation of the charity.

You might remember that we featured these findings in April 2014 in our report on a fundraising research conference.

7. Creation of the Marshall Institute for Philanthropy and Social Entrepreneurship

The Marshall Institute for Philanthropy and Social Entrepreneurship will be launched at the London School of Economics (LSE) later in 2015. Its aim is to improve the impact and effectiveness of private contributions to the public good.

Created by Sir Thomas Hughes-Hallett, former CEO of Marie Curie for 12 years, and Paul Marshall, the Marshall Institute “will inform and coordinate the efforts of activists, researchers, private citizens, foundations, corporations, public bodies and social entrepreneurs”.

It was made possible by a £30 million donation from Paul Marshall, chairman and chief investment officer of hedge fund group Marshall Wace LLP.

8. Gift Aid doesn’t inspire wealthy to give, but it does motivate them to give more

Research by HM Revenue & Customs into the role of tax reliefs in motivating wealthy individuals to give to charity has found that tax relief on its own does not motivate them to give.

However, it does seem to give them an incentive to give more, because they understand they will receive tax relief at the end of the year.

HMRC’s research confirmed plenty of other research into motivations into giving in that they found that common reasons were:

- social influences (such as requests from friends)

- emotions – for example, the feeling of having done a good deed

- identity – giving as part of the donor’s belief system or identity

- outcomes – knowing and seeing the difference that their donation will make

HMRC interviewed 32 individuals who earned over £100,000, gave to local and national charities, whether regularly or one-off gifts, and who had claimed tax relief on a charitable donation of at least £100 in 2013 to 2014.

HMRC described the individuals as “better off” rather than wealthy.

Not all donors who were interviewed were clear how much they would get back in tax relief. Overall they found the system for claiming relief both easy and fair for both charity and donor.

You can download the research findings Qualitative research to understand charitable giving and Gift Aid behaviour amongst better-off individuals

Rhodri Davise, a researcher at Charities Aid, argued that this research was “a missed opportunity”. He questions the validity of such a small sample, and the lack of evidence of any changes in donor behaviour to back up what they told HMRC.

9. Understanding Philanthropy

The Centre for Philanthropy at the University of Kent held a one-day conference on Understanding Philanthropy on 29 June at which 150 fundraisers, grantmakers and fundraising researchers gathered.

A new book, Hidden History: Philanthropy at the University of Kent, by Dr Triona Fitton, was launched at the event.

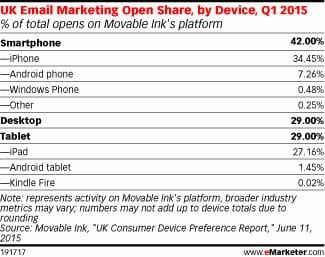

10. Emails are much more likely to be opened on a mobile device than desktop

According to Movable Ink, 71% of all email opens in the UK in the first quarter of 2015 took place on a mobile device. If you’re still assuming that your supporters are all viewing your emails on a desktop, the figure for emails opened on a desktop is currently at 29%.

So, are your charity’s emails mobile responsive? In other words, are they legible, do they fit the smaller screen well, are clickable links suitably far away from others etc?

11. Free fundraising data calculators in the M+R toolshed

US fundraising and campaigning agency M+R has shared a growing collection of free online calculators for charity fundraisers and marketers.

Visit its M+R Toolshed to run a:

- Chi-Square test for response rates

- t-test for average gifts

- revenue per recipient test for conflicting results

You can even benchmark your online results against (US) statistics for nonprofits, and receive the result in an infographic.

12. Naming charities doubles response and donations compared to choosing your own charity

A small change to a charitable giving form can double the number of people who respond and the amount given.

Students were asked to consider donating a proportion of their earnings to charity and then to decide what percentage they would give. Some were presented with a list of five well-known charities, others with a blank box in which they could enter the name of a charity.

Research by Jonathan Schulz, Petra Thiemann and Christian Thöni at the Centre for Decision Research and Experimental Economics at the University of Nottingham found that “offering a list of default charities doubles both the fraction of donors and the aggregate amount of donations”.

Why? The researchers consider that by naming a particular charity the students experienced an emotional response in that they at least pictured what the charity does and whom it helps.

They conclude that “our results strongly highlight the importance of ‘choice architecture’… in donation decisions”.

You can download ‘Defaults in charitable giving‘ (published in April 2015).