Charities urged to prepare for image-based cheque clearing

The cheque as a method of payment and donation is far from dead, despite proposals some years ago to withdraw them by the end of this decade. Indeed, they are set to get a new lease of life with the introduction of image-based cheque clearing.

This was the message given to charities at the recent The Future of Charity Payments seminar, hosted by The TALL Group of Companies, SmartDebit and iATS Payments in London.

Representatives from leading charities including Tearfund, Great Ormond Street Hospital and the RNLI heard from a number of leading players from the payments industry at the event held at the Royal Society for the Encouragement of Arts, Manufactures and Commerce.

Delegates were encouraged to liaise with their banks so that they could prepare themselves for the planned introduction of the new method of payments.

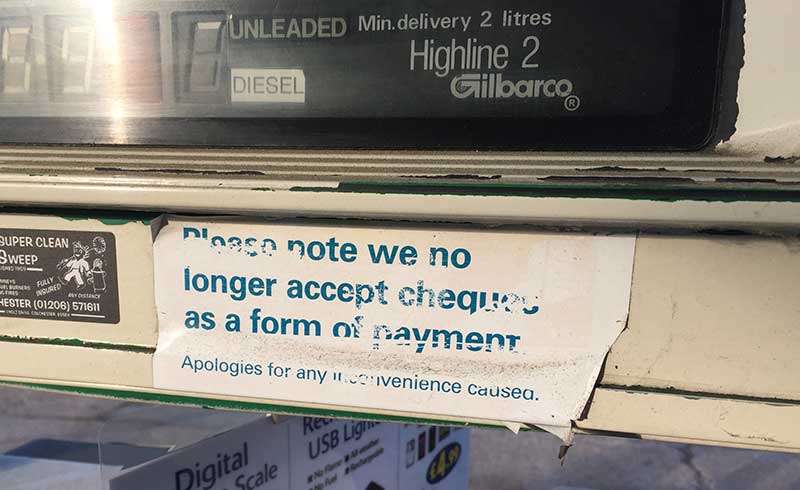

Cheques no longer accepted – but digital imaging of cheques should change that.

When will image-based cheque clearing start?

Introducing cheque imaging in the UK requires a legislative change, which has been incorporated within the Small Business, Enterprise and Employment Bill. The approved Bill received Royal Assent on 26 March 2015, and the enabling legislation comes into force on 31 July 2016, after which time imaging can be introduced in the UK.

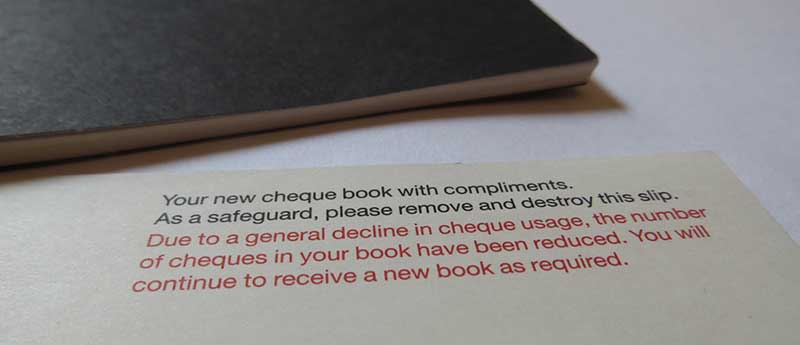

Banks report a decline in cheque usage – but cheques are about to stage a digital comeback

Between now and the legislation coming into force next year, the Cheque and Credit Clearing Company is working with the banking industry to agree the changes to the infrastructure and technological capabilities required before the process can be introduced. A specific timeframe for the project to complete will be announced over the coming months.

HMRC announced a consultation into combining cheques and smartphone technology in December 2013.

Images to supercede paper

Once fully implemented all banks will be required to clear cheques on the image and data files alone, and no further paper cheques will be exchanged between banks in achieving the clearing process.

Advertisement

Cheques still important to charities

Fiona Gledhill, Project Manager from the Cheque & Credit Clearing Company (C&CC), explained that whilst the volume of cheques in the UK has dropped from 4 billion in 1990 to 644 million in 2014, they continue to play a vital role in a charity’s fundraising operations.

She said:

“Cheques are still important and they are here to stay, however we need to make them more efficient and sustainable for the future and cheque imaging will do this. Our market research found that 86% of charities say that cheques are important to them and cheque imaging will mean that cheque usage is protected.

“There will be new ways to pay in cheques but those charities who want to carry on paying in cheques as they do at the moment, will be able to do so. One way or another the introduction of image-based cheque clearing will have an impact upon charities. They will be required to make changes to their internal systems and they will need to talk to their bank in order to prepare thoroughly.”

According to research by Ipsos MORI, fewer than 0.5% of charities had neither sent nor received a cheque in the apst year.

Benefits to charities

Cheque imaging will bring many benefits for charities, delegates heard, speeding up the clearing process so they get access to funds from their supporters and donors sooner.

They will still be able to pay cheques in at a branch where their bank will scan the cheque to create an image for processing. However, in addition, their bank may offer them new ways to pay in, such as scanning software linked to their online banking so that they can upload cheques themselves for paying in and processing.

Mark Temple, Key Account Manager from The TALL Group of Companies, reported that the Group is participating in the C&CCC’s Cheque Printer Advisory Group, working with the company and other group members and sharing its expertise on cheque security features, image survivable content, and fraud detection in the image world. He reassured the audience that:

“Currently, there is a large investment in technology taking place that will help to boost fraud detection as we move towards the new system.”

Delegates at the event also heard from Mark Hargrave, CIO at SmartDebit, who explained how charities could remain secure from outside threats whilst Don Hollingum from Bacs, shared best practices for the scheme.

Tom Epplett, CEO of iATS rounded off proceedings by providing an insight into future payment types for charities, including mobile wallets, text2give and Bitcoin.

* Read UK Fundraising’s coverage over developments in cheques for donations.