Why are charities paying too much for their energy?

If charities don’t keep a close eye on utility bills, they could very well be missing out on money that could be better spent in other areas of the organisation.

Every year, cash-strapped not-for-profit organisations and charities are losing money on their gas and electricity bills. Financial managers may not be aware that there are simple small changes these organisations can make that mean big savings on energy for charities.

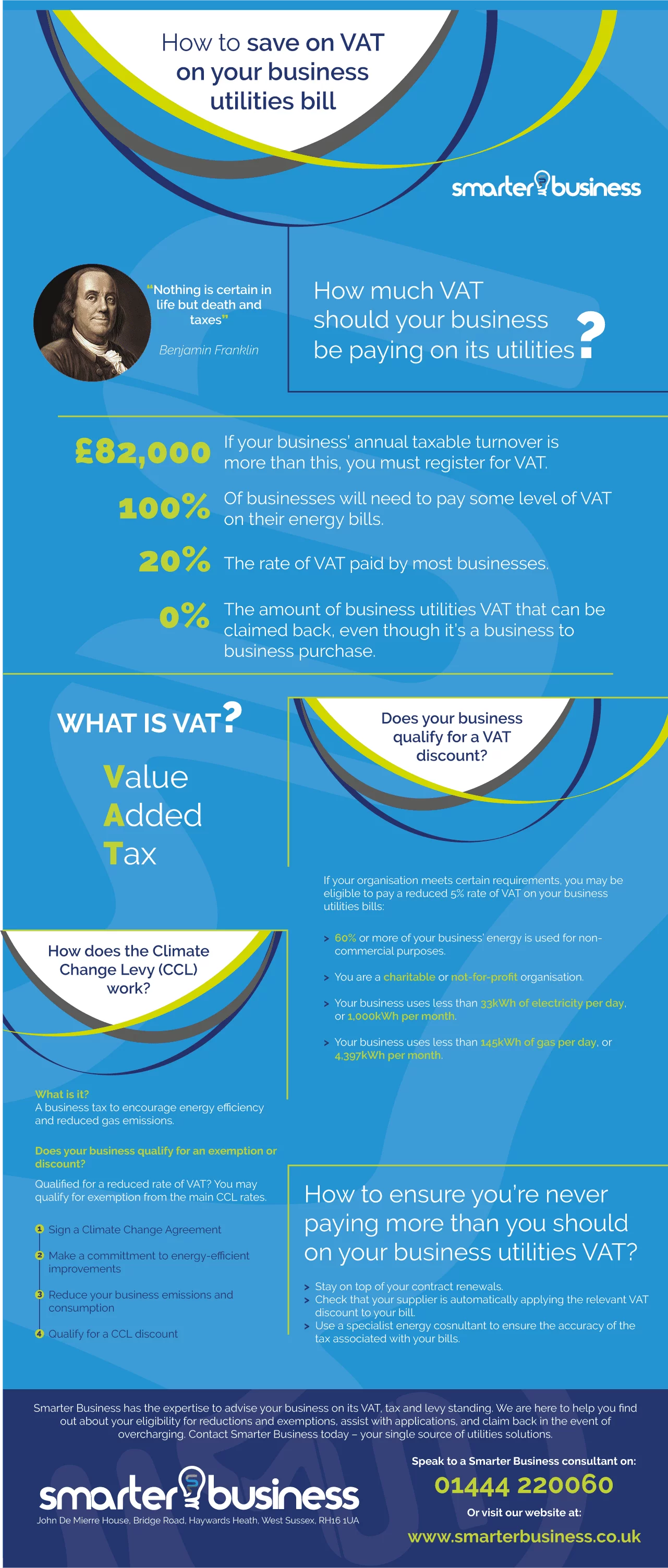

Despite these rigorous reporting structures, these organisations are often overcharged for gas and electricity, unaware of VAT reductions, exemptions and rebates.

Advertisement

Who qualifies for the reduced rate?

- Over 200,000 charities who are registered in the UK

- Smaller, unknown charities with an income below £5,000

- Not-for-profit organisations such as community centres, village halls, sports clubs, free schools, self-catering accommodation, Scout and Guide groups, care homes, Women’s Institutes etc.

- Businesses using less than 4,397 kWh of gas or 1,000 kWh of electricity per month also qualify for a reduced VAT rate

Why are charities being overcharged?

- Energy suppliers treat charities like small businesses, and often neglect to put charities on their correct VAT rates by default

- Charities are unaware of the relevant exemptions and reductions

- Organisations are unaware that they can claim back on overpayments from up to four years ago

- Along with a lack of knowledge is a lack of action, since the onus is on the charity organisation to apply for the discounts (read on to find out how to do this)

- Shopping the market for the best rates is time-consuming for finance and admin teams who are likely already stretched

How much extra are you paying?

The normal VAT rate on energy is 20%, but charities should have a VAT rate of only 5% for gas and electricity used for ‘non-business ’purposes. Charities are also exempt from the Climate Change Levy (CCL), further reducing energy bills by 5%. These reductions can represent significant savings for the organisation.

What your charity can do?

First, dig out your energy bills and check your VAT rates. If the VAT rate is the standard 20%, you should take action to claim the correct VAT rate going forward. The good news is that you are also able to claim a rebate for money incorrectly charged for the last four years. This means that you can claim back on VAT overspend on your energy bills from as far back as 2014. This money can then be channeled back into the organisation and the causes you support.

To apply for rebates or exemptions, eligible organisations will need to fill out a VAT Declaration form from their supplier. After receiving the VAT Declaration form, the supplier will usually take about two weeks to review the application and apply the discount.

It is also recommended to use an independent consultant to advise your charity on the correct VAT rates and assist with rebate claims. They will take the stress out of the process and free up your internal resources to carry on doing what they do best. Another benefit of an independent review is that the consultant will also be able to obtain and compare quotes from different suppliers, securing the best deal for your charity and implementing a strategy to maximise the cost-effectiveness of your charity’s energy contract.

Shea Karssing is a writer at Smarter Business, the independent consultancy helping charities secure the most comprehensive savings solutions from utilities contract management. Partnering with Smarter Business means you have a team of experts on-hand to assist with your electricity and gas procurement, management, and strategy requirements. The company’s experience in the not-for-profit sector gives them intimate knowledge of the structures that should be in place around your unique energy bills.