Tips and traps for Gift Aid efficient donor incentive schemes

Charities can provide donors with minor benefits but still be able to qualify for Gift Aid. Many charities use this feature to incentivise donors via Gift Aid efficient ‘friends of’, ‘supporter’ or ‘patron’ schemes, which provide donors with small levels of benefit in return for Gift Aid donations.

However the rules on donor benefits are complicated and can be a major source of grief for charities.

Overview

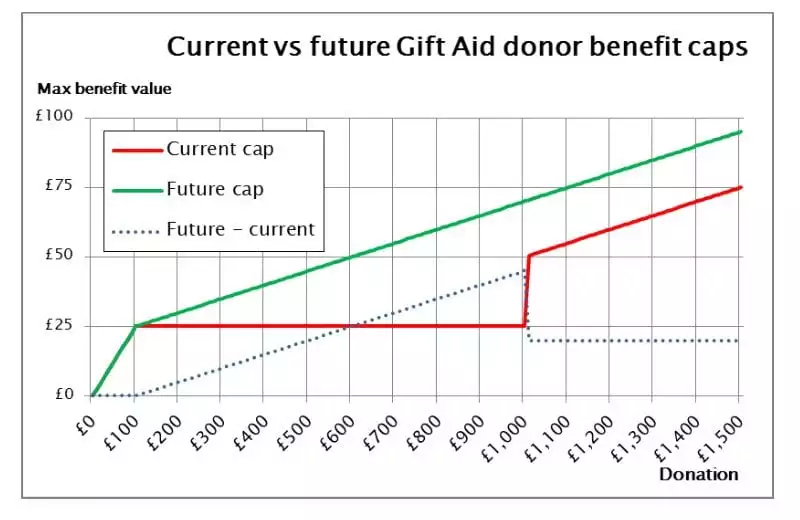

At the autumn budget, the government announced the donor benefit rules will simplified and made slightly more generous with effect from 6 April 2019. The changes will mainly benefit donations in the £500 – £1,000 range.

Advertisement

However these changes will not affect the key decision that has to be made with donor incentive schemes. This is whether or not to use:

- The ‘under the threshold’ approach, where a minimum ‘donation’ is specified, the donor benefits are within the Gift Aid donor benefit limits and the entire minimum donation can be Gift Aided, or

- The ‘split payment’ approach, where the donor’s payment is split into a fee for the benefits, which is not available for Gift Aid, and a donation, which is can be made with Gift Aid.

Current donor benefit limits

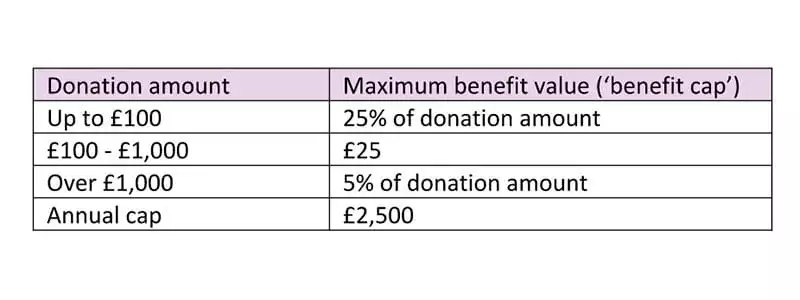

Charities can provide donors with a small level of benefit in return for a Gift Aid donation without the donation ceasing to qualify for Gift Aid. The limits are currently:

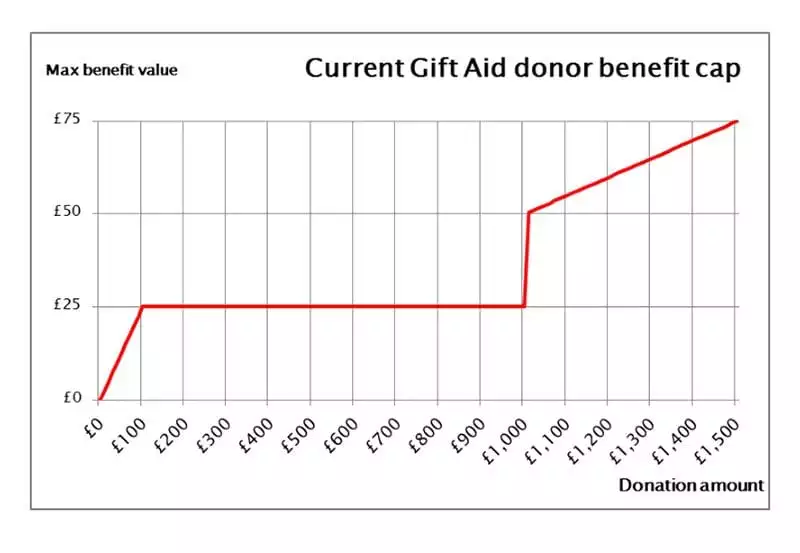

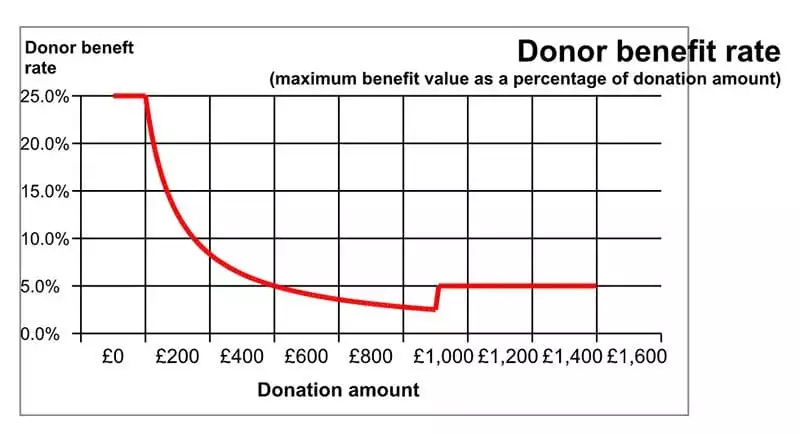

Small donations of up to £100 are treated the most favourably, with the benefit cap set at 25% of the donation amount. The cap is then a fixed £25 for donations of between £100 and £1,000, then 5% for donations of more than £1,000.

These limits are seen as being complicated to operate in that they have 3 levels of donation (up to £100, £100 to £1,000 and over £1,000) and a mix of different rules for each level (percentage of donation or fixed amount).

They create a particular problem for donations in the £500 – £1,000 range, where the cap is a fixed £25 and does not increase in proportion to the donation amount. This disincentivises donations in this range and increases the chances of such donations breaching the donor benefit limits.

The limits also mean that between £1,000 and £1,001, the cap jumps from £25 for a donation of £1,000 to £50.05 for a donation of £1,001. So increasing a donation by £1 from £1,000 to £1,001 increases the benefit cap by £25.05.

Donor benefit limits from 6 April 2019

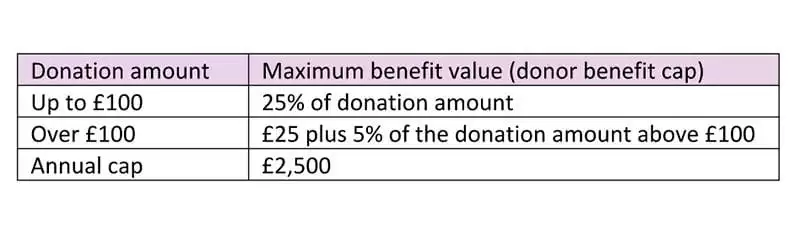

The government has decided to address these problems. With effect from 6 April 2019 the donor benefit limits will be increased as follows:

It is important to note that no one loses, for all donation amounts, the donor benefit limit either stays the same or increases:

The rules are simplified in that there will be two levels (donations of under or over £100) and two rules, though the rule for over £100 donations will be a mix of fixed amount and rate and thus more complicated that any of the current rules. However a major advantage of this approach is that the disincentive for donations between £500 and £1,000 is removed as is the issue at £1,000.

This change is likely to benefit many of the starter level ‘friends’ type donor incentive schemes run by charities which are operated as under the threshold schemes (where the benefits provided to donors are within the donor benefit limits). To date many of these schemes have been limited to donations of somewhere between £100 and £250 due to the benefit cap problem for donations in the range £100 – £1,000. The changes should allow charities to create a greater variety of under the threshold friends type schemes with higher minimum donations.

However it is not always advantageous to operate donor incentive schemes as under the threshold. The alternative is to use the split payment approach. This can a better choice overall, when VAT is also taken into account.

The split payment approach

Where the benefit value would exceed the donor benefit limits it is possible to split a donor’s payment, so part can be treated as a fee without Gift Aid for the benefits and the balance as a donation with Gift Aid. In order to use this split payment approach:

- the benefits must be available for purchase separately from the fee amount, and

- the donor must have been made aware of the value of the benefit at the time the donation was made

In order to meet these conditions, the donor must be told they can purchase the benefits for the fee only and that any additional payment is a voluntary donation which is eligible for Gift Aid. So with the split payment approach charities run the risk that donors will decide to purchase the benefits for the fee only and charities have to rely on donors’ goodwill to make the additional voluntary donations.

The VAT trap

A not uncommon mistake with under the threshold schemes is to assume that because any benefits are seen as de-minimis for Gift Aid purposes, the same applies for VAT with the result that the minimum payment can treated as outside the scope of VAT.

Unfortunately this is wrong. Where there is an agreement that, in return for a specified minimum payment, a donor will be entitled to a package of benefits, then for VAT purposes the benefits are seen as supplied in return for the minimum payment and the minimum payment is subject to VAT.

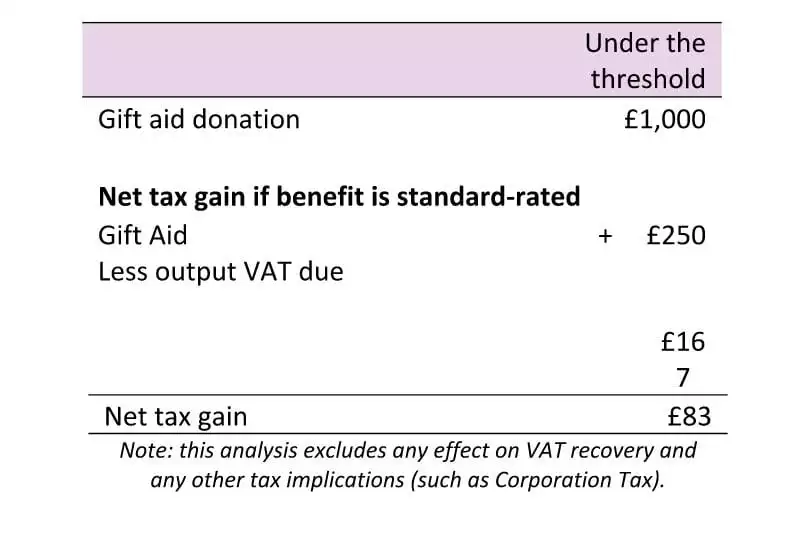

This means that if the benefit package is standard-rated for VAT, VAT is due on the entire minimum payment.

This can substantially reduce the overall tax advantage, for example if a donor must make a minimum payment of £1,000 to secure a package of benefits valued at £25 and the benefits are standard-rated for VAT, the combined effects of Gift Aid and VAT are to reduce the overall tax gain to £83:

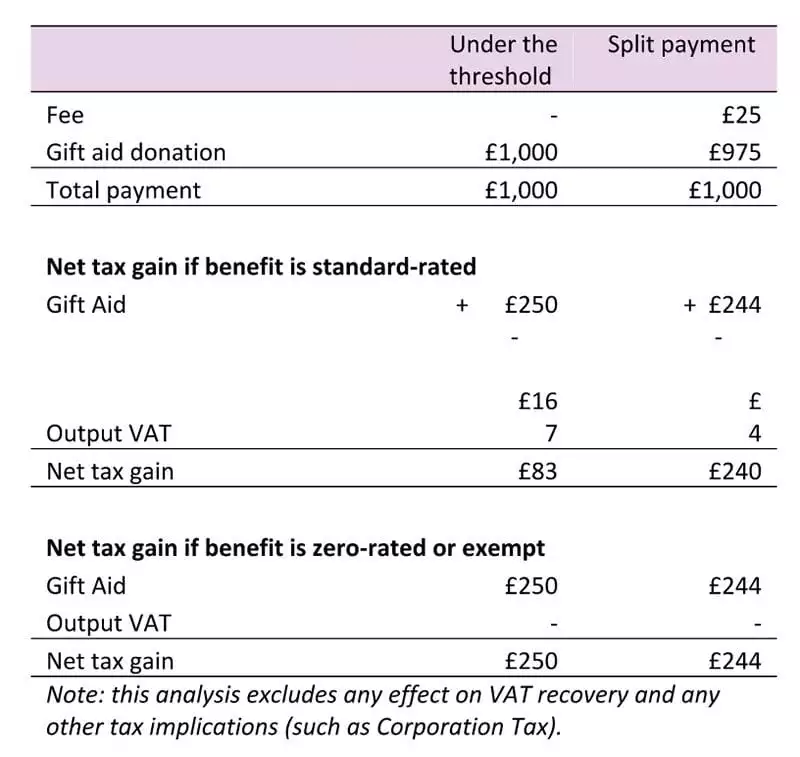

However HMRC accepts that under the split payment approach, only the fee element is subject to VAT with the voluntary donation treated as outside the scope of VAT.

This means that, as far as tax is concerned, it will generally be better to use a split payment approach if the benefit package is VAT standard-rated and an under the threshold approach if the benefit package is zero-rated or exempt.

For example for a £1,000 donation with a benefit package valued at £25:

Using the split payment approach, the net tax gain is £240 as opposed to £83 using the under the threshold approach, if the benefit is standard-rated for VAT. However if the benefit is zero-rated or exempt, it is slightly better to use the under the threshold approach, if available.

The VAT status of the benefit package is thus a critical factor that should be taken into consideration when deciding on whether or not to use the split payment approach for a donor incentive scheme

SEE ALSO VAT implications of charity supporter schemes

Helen Elliott is a partner at Sayer Vincent LLP which provides audit, tax and other advice to charities.