Funding the Fundraising Regulator

I am concerned that the Fundraising Regulator’s proposals for raising a levy on charities are unfair and do not reflect a fair allocation of costs to charities of different sizes.

It is the Regulator’s proposal that the charities with the highest level of expenditure should have their levy capped. This seems both unbalanced and unfair on smaller charities. It does not reflect the fact that the need for the new regulator was largely created by the actions of the largest charities.

The release on 5 July 2016 of the 2016 FRSB Complaints Report adds evidence to this point.

In his foreword, Andrew Hind notes:

“Major charities with annual income over £10m carry out 83 per cent of all fundraising activity by volume, and just 15 of these household-name charities are responsible for generating nearly two-thirds (62 per cent) of all reported complaints.”

This statement alone suggests to me that it is these charities that should bear the lion’s share, and a fair proportion, of the cost of the regulator. From the tables outlining the proposed levy structures larger charities will be paying proportionately significantly less than all other charities. This is to fund an organisation created largely as a result of their activities. Further, the majority of the work the regulator is likely to have to do in relation to complaints will be about their fundraising.

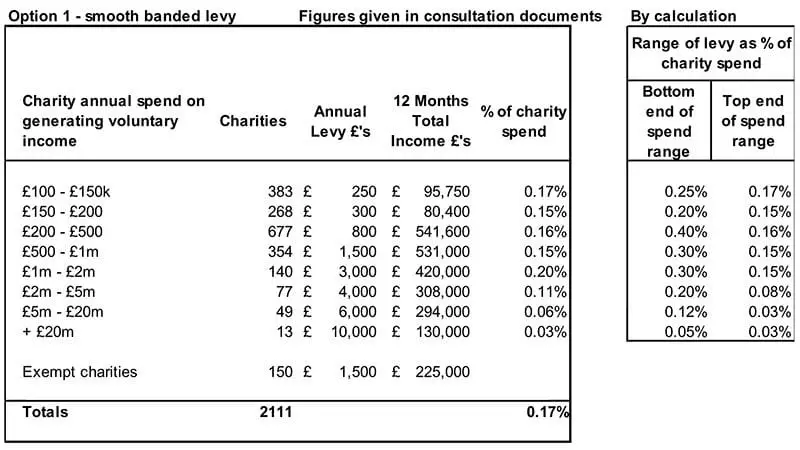

In the consultation appendix the regulator’s preferred option shows that the largest charities (above £5m expenditure) will be paying 0.03% or 0.06% of their annual spend on generating voluntary income.

The remaining charities will be paying between 0.11% and 0.2% of their income.

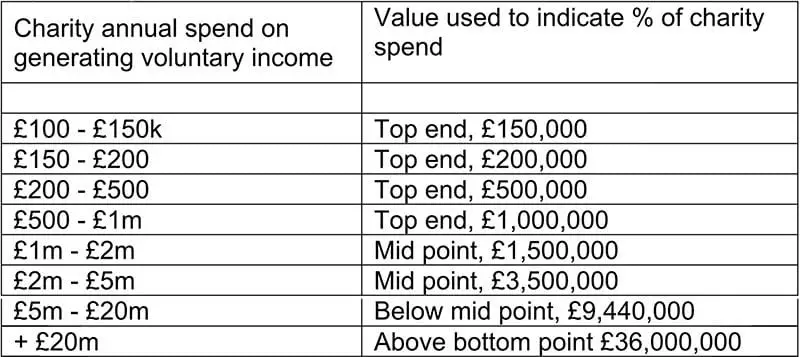

However the figures provided by the regulator in the Annex to the consultation document are misleading. The % figures are calculated using different figures for different expenditure bands. In some instances the top end of the spend range is used, in some the mid value and in some another figure altogether. This makes meaningful comparison of the relative cost impact impossible.

Specifically:

Given that option 1 in the consultation uses banding based on charities’ annual spend on generating voluntary income, it would seem misrepresentative to not use those same point in each range when calculating the percent of charity spend that the proposed levy would represent.

The calculation below gives the % of spend based on the top and bottom figure of each range:

I believe the figures as used in the regulator’s example are misleading as they misrepresent range of inequality between the highest and lowest % of charity spend.

In the original table this range is 0.03% up to 0.20%, whereas in fact the range is from 0.03% to 0.40%. This increases the disparity in levy from 6 times the rate to 13 times the rate.

Advertisement

Options 2 and 3

Under Options 2 and 3 the regulator has consistently refused to disclose the proposed percentage levy in the options.

In my view this fundamentally weakens the consultation exercise as it is not possible to accurately evaluate the difference between charities of different sizes. However, it is clear that similar differences apply.

Using the figures provided by the regulator under Option 2, 15 charities (assuming they are the highest spending and generating the 62% of complaints) will contribute £300,000 in levy fees. Just 11% of the total proposed income.

Under Option 3 it is harder to estimate, but let’s assume that 16 pay between them £540,000. Six at £40,000 and 10 at say £30,000 average. This would still equate to only 21% of the total proposed levy being paid by those potentially responsible for 62% of the complaints.

This regulator’s proposals for a cap do not seem fair or proportionate. Either by way of the size of the charity or by way of responsibility for the current situation.

The regulator’s explanation for the proposed cap in the consultation document is that higher, and thus proportionate, fees for the high spending charities “could be seen or said to influence the Fundraising Regulator or have a stake in its operations”.

Given the makeup of the regulator, under the chairmanship of Lord Grade, I am concerned that they do not feel able to resist such influence. Further, given the announcements in recent days about public consultation on any future changes to the Code of Fundraising Practice, the ability to influence will be further controlled.

An alternative

It seems to me that a simple percentage levy based on fundraising expenditure with a threshold at which the levy starts but without a cap at the top end would be fairest.

Sadly the regulator appears to have discarded this possibility.

What would this mean in practice? An analysis of the information provided in the consultation appendix shows that the regulator is seeking to raise £2.4 million from the levy on the charities.

Assuming the distribution of spending in each band is even one can take the mid-point to calculate the approximate total charity expenditure in each band. This would give a total annual spend on generating voluntary income from charities with an expenditure above £100,000 of £1.864 billion.

Using that figure it is easy to calculate that a simple levy of 0.13% would provide the level of income required.

Does this make a difference? Yes.

- A charity with annual spend on generating voluntary income of £100,000 would face a levy of £130 rather than £250.

- A charity with annual spend on generating voluntary income of £200,001 would face a levy of £260 rather than £800.

- A charity with annual spend on generating voluntary income of £20,000,000 would face a levy of £26,000 rather than £6,000.

Is this fairer, I think so, but do let the Regulator know what you think!

Simon Wigglesworth is deputy chief executive, Epilepsy Action